Get the free vermont bi 471 form - tax vermont

Show details

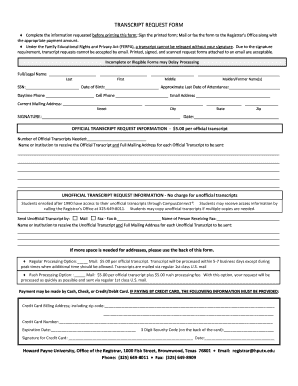

8. continued on back Form BI-471 Rev. 10/08 SCHEDULE 1 TAX PAYMENTS and CREDITS COMPUTATIONS 10. Estimated Payments and Payments with Extension.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vermont bi 471 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont bi 471 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vermont bi 471 form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vermont bi 471 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out vermont bi 471 form

How to fill out the Vermont Bi 471 form:

01

Start by obtaining the Vermont Bi 471 form from the relevant source, such as the Vermont Department of Motor Vehicles website or your local DMV office.

02

Carefully read the instructions provided with the form to understand the requirements and ensure you have all the necessary documents and information.

03

Begin by filling out the personal information section, including your full name, address, date of birth, and contact information.

04

Proceed to provide the necessary details about your vehicle, such as the make, model, year, and Vehicle Identification Number (VIN).

05

Fill in the appropriate sections regarding the transfer or purchase of the vehicle, including the previous owner's information, if applicable.

06

If you are registering the vehicle for the first time, indicate this on the form and provide any additional information required.

07

Include the required payment for any applicable fees, including registration fees and sales tax.

08

Finally, review the completed form to ensure accuracy and legibility, and sign and date it where instructed.

Who needs the Vermont Bi 471 form:

01

Individuals who want to register a vehicle in Vermont for the first time.

02

Individuals who have purchased a vehicle from another owner in Vermont.

03

Individuals who have recently moved to Vermont and need to register their out-of-state vehicle.

04

Individuals who need to transfer the title or ownership of a vehicle in Vermont.

05

Individuals who need to update or renew their vehicle registration in Vermont.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vermont bi 471 form?

The Vermont BI-471 form is a Business Income Tax Return form used by taxpayers in the state of Vermont to report their business income and calculate the amount of income tax owed. This form is specifically for business entities such as corporations, partnerships, and limited liability companies. It requires the taxpayer to provide detailed information about their business income, deductions, and credits. The form is typically filed annually, along with any applicable schedules or supporting documents. It is important to note that the specific requirements and instructions for completing the BI-471 form may vary based on the type and size of the business entity.

Who is required to file vermont bi 471 form?

The Vermont BI-471 form is required to be filed by a business entity that is either seeking to incorporate or expand an existing business in the state of Vermont. It is specifically for the purpose of registering as a business entity.

What is the purpose of vermont bi 471 form?

The Vermont BI-471 form is a State of Vermont document used to report motor vehicle crashes. It is primarily used by law enforcement officers to record necessary information about a motor vehicle accident and submit it to the Vermont Crash Analysis & Reporting Unit. The purpose of this form is to document details such as date and location of the accident, involved parties, fatalities or injuries, contributing factors, and other relevant information. This data is then compiled and analyzed to improve road safety, identify trends, and assist in developing accident prevention strategies.

What information must be reported on vermont bi 471 form?

The Vermont BI 471 form, also known as the Annual Report of Motor Vehicle Liability Insurance, requires the following information to be reported:

1. Insurance Carrier Information: The name, address, and NAIC number of the insurance carrier providing the liability insurance coverage in Vermont.

2. Policy Information: The policy number, effective and expiration dates of the liability insurance policy.

3. Vehicle Information: The year, make, and vehicle identification number (VIN) for each insured vehicle. This includes both private passenger and commercial vehicles.

4. Liability Coverage Information: The policy limits for bodily injury and property damage liability coverage. This includes the minimum limits prescribed by Vermont law.

5. Premium Information: The total premium paid for the liability insurance policy.

6. Authorized Representative: The name, title, and contact information of the person authorized to represent the insurance carrier.

7. Certification Statement: The form should be signed and dated by an authorized representative of the insurance carrier, certifying the accuracy of the information provided.

It's important to note that these requirements may vary over time or depending on the specific version of the form. It is recommended to refer to the most recent version of the Vermont BI 471 form or consult with the Vermont Department of Motor Vehicles for the most accurate and up-to-date information.

What is the penalty for the late filing of vermont bi 471 form?

The Vermont BI 471 form refers to the Business Income Tax Return. The penalty for the late filing of this form can vary depending on the circumstances and the amount of tax owed. It is recommended to contact the Vermont Department of Taxes or consult with a tax professional for specific details on penalties and interest related to late filing.

How to fill out vermont bi 471 form?

To fill out the Vermont BI-471 form, follow these steps:

1. Obtain the form: You can either download the form from the official website of the Vermont Department of Health or get a physical copy from a local health department office.

2. Fill out the first section, "New Owner Information", which includes your name, address, city, state, and ZIP code. If applicable, provide your phone number and email address.

3. In the next section, "Animal Information", provide details about the animal you are registering. This includes the species (such as dog, cat, horse, etc.), the animal's name, breed, color, age, sex, and whether or not it is spayed/neutered.

4. If you have previously owned this animal or if you acquired it from another Vermont owner, check the appropriate box and provide any relevant details.

5. In the "Rabies Vaccination Information" section, enter the date of the animal's current rabies vaccination, the type of vaccine used, and the date it expires. Provide the name, address, and telephone number of the veterinarian who administered the vaccine.

6. Indicate whether the animal is leased, rented, or owned. If you are not the owner, provide the owner's information.

7. If you are the owner, sign and date the form. If you are not the owner, the owner's signature is required.

8. Make a copy of the completed form for your records and mail the original to the address specified in the instructions, along with any required documentation and fee (if applicable).

Note that this information is a general guideline, and you should refer to the specific instructions provided with the form for any additional requirements or details.

How do I modify my vermont bi 471 form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your vermont bi 471 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute vermont bi 471 form online?

pdfFiller has made it simple to fill out and eSign vermont bi 471 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit vermont bi 471 form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your vermont bi 471 form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your vermont bi 471 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.